How to Ensure High Risk Workers’ Comp Coverage Through Specialty Markets

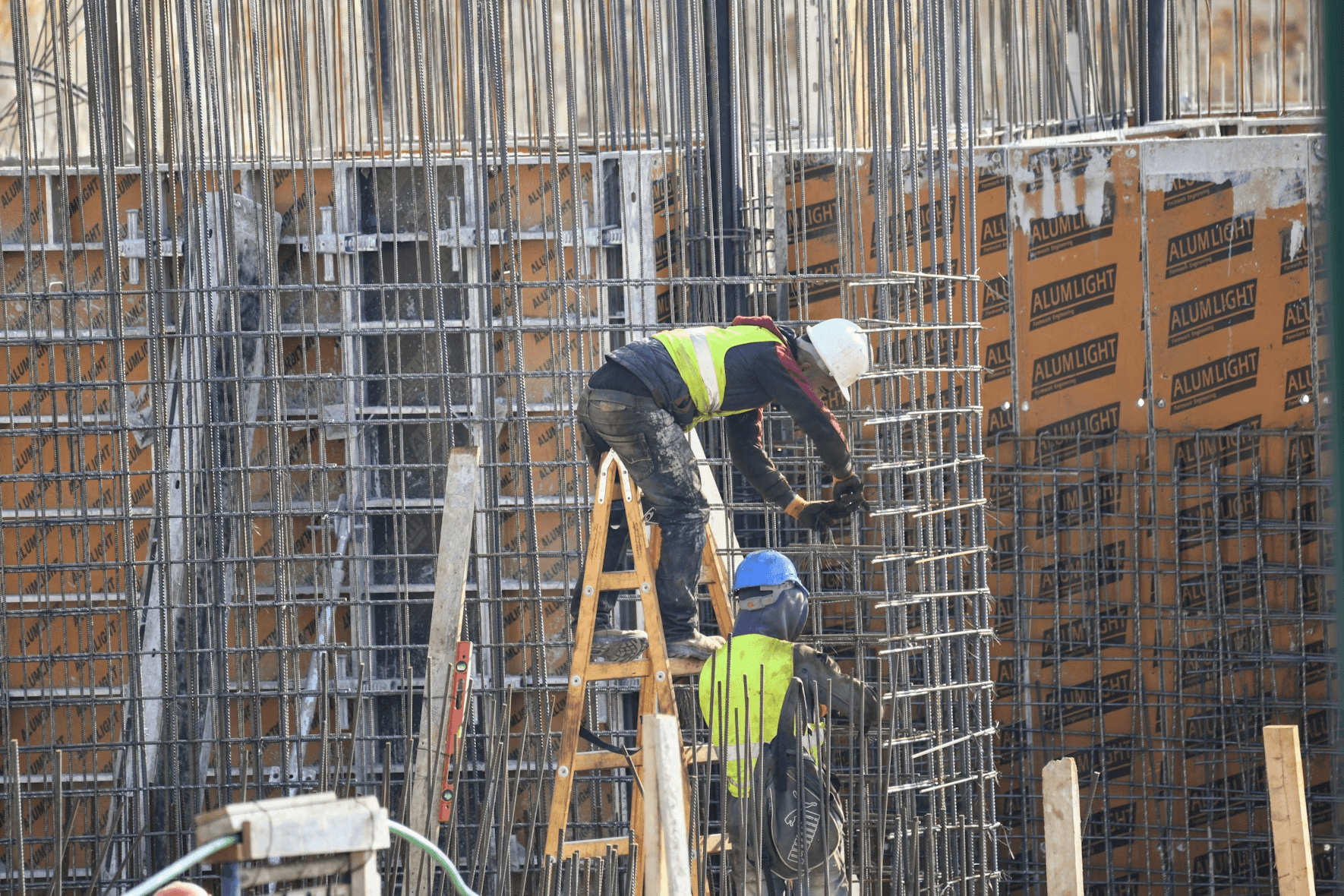

Every year, thousands of workers in industries like construction, roofing, trucking, and manufacturing face real dangers on the job. Falls from ladders and scaffolds, heavy equipment accidents, vehicle collisions, electrocutions, and more. These are not just stats, but life-changing events that can happen in a split second.

According to the International Labor Organization, globally, up to 330,000 people die of work-related accidents every year, while about 395 million sustain non-fatal injuries. Of this number, high-risk industries like agriculture, manufacturing, construction, and forestry account for 63% of all fatal injuries.

If you own or run a business in any of these industries, you’ll agree that these numbers are not just alarming, but a stark reminder of the responsibility you owe your workers to protect them.

Unfortunately, for many business owners in these niches, getting workers’ compensation insurance feels like hitting a brick wall. Standard insurers see your industry as high risk and either refuse to cover you or hit you with unrealistic premiums.

The good news is that there’s an entire ecosystem of specialty insurance providers whose business model is built around solving this exact problem.

This article covers all you need to know about securing high-risk workers’ comp coverage through specialty markets and how you can go about it.

What Makes Workers’ Comp “High Risk”?

So, how do insurance companies decide which business is high risk and which aren’t?

It boils down to simple math. If your employees are working regularly at great heights, with heavy machinery, or in potentially dangerous environments, the statistical probability of a serious and expensive injury is just higher.

Think about it for a moment. A software developer vs a roofer. How often does a software developer fall from a ladder? Even if it happens, that can be classified as a workplace incident. Now compare with someone roofing a two-story building. A fall from a ladder or scaffold at that height is a life-altering event, and insurers know that.

Then there’s the data part of it. If the data says that your job is dangerous, your classification, or “class code,” is automatically flagged.

Insurers also look at your experience modification rating (EMR Rating). This is basically a report card of your past workers’ comp claims. A high EMR rating, combined with a risky trade, is what sends you to the so-called high-risk pool.

What Are Specialty Markets and Why Do They Matter for High-Risk Employers?

This now brings us to the interesting part: specialty markets and how they can help high-risk employers.

Simply put, they are insurance companies, or in some cases, special divisions within them, that focus on businesses standard carriers won’t touch.

These specialty markets, also called the Excess & Surplus (E&S) market, don’t see a welding company or a mining company and immediately see risk. They see a business in a specific niche, with unique safety protocols, specialized equipment, and trained crews. These are the providers that have the guts and the expertise to cover tough niches like these.

How to Secure Workers’ Comp Through Specialty Markets

So, how do you actually get this coverage? As you can see, it’s not like buying regular insurance. Here’s how to do it right.

Partner With a Specialist Broker

Getting high-risk workers’ comp starts with looking for and working with a reliable specialist broker. This is probably the single most important step you can take because you cannot access the E&S market directly.

These brokers know which providers are writing policies for your type of business and how to present your case to them in the best light. According to Worksperity, such brokers can provide reliable access to hundreds of markets designed for hard-to-place clients like you.

Prepare Your Business Information

Specialty carriers love details. You need to be ready to share lots of details relating to payroll numbers, class codes (what your workers do), loss history, safety policies, and more. You’ll also likely need at least five years of loss runs (that’s your claims history), a list of your safety equipment and training programs, and your OSHA 300 logs if applicable.

To avoid any delays, it’s best to have all the necessary details put together before even starting the conversation. A good broker can point you in the right direction.

Demonstrate Risk Mitigation

This is where you can make a big difference. Show them that you’re serious about workplace safety and that you have a workable policy in place for it.

For best results, document your safety meetings and your equipment maintenance schedules. If you’ve implemented return-to-work programs or hired a safety consultant, make sure that’s front and center.

Be Transparent About Past Claims

It’s tempting to want to hide a bad claim year, but this will never work with specialty markets. A better move is to lay it all out in the open: your claim history, any big incidents, how they happened, and what you did afterward.

If you’ve made changes or improved your safety since then, you’ll score points. Even if you haven’t, being transparent shows some level of responsibility, which can build trust during the underwriting process.

Compare Quotes and Coverage Options

The E&S market is a lot more flexible than traditional insurance. As a result, policy language and exclusions vary significantly. This gives you the freedom to compare options.

Don’t just look at the premium price. Go into the details. Some providers may offer broader coverage options (like higher limits or added benefits), while others may be more competitive on price. The goal here is to strike the right balance between cost and protection.

Whether it’s a car, a house, or E&S markets, experts recommend getting quotes from three providers at least. But you can push for five if that’s possible.

Conclusion

If you operate in a high-risk industry, you no longer have to settle for NO from traditional insurers. You can get the cover you need for your workers by tapping into specialty markets.

To quickly recap:

- Work with a knowledgeable specialist broker

- Get your documentation in order before even starting

- Show that you’re serious about safety and risk mitigation

- Be open about past claims

- Let your broker help you shop around

Do all these and you’ll find that getting workers’ comp for your high-risk business, while not easy, isn’t impossible. Because the truth is that the right coverage is out there; you just need to know where to look.