Why Businesses Still Shouldn’t Overlook Traditional Payment Methods

Many businesses still use traditional payment methods. Statistics show they also hold value for customers. We discuss them in the article below.

The cashless society has been promised for some time now. Yet customers still like options when it comes to payment, and many of these focus on traditional methods. From phone payments to cash, and even down to checks, these methods are still in everyday use. Read on as we dive into why businesses should never overlook traditional payment methods.

Accepting Phone Payments

One industry that has grown vastly by accepting a wide range of payments, combining both traditional and modern, is the online casino industry. While it has very up-to-date ways to pay, such as digital gateways and even cryptocurrencies, it also allows more old-fashioned methods and knows their value. For example, Bonusfinder pay by mobile casinos page is one of the most visited casino review sites. Pages like this have been great for spreading online casinos into emerging markets where the infrastructure for other methods may not be available. By ranking bonuses and customer service, even those using less frequented methods still get the same level of service.

By introducing phone payments like this to your business, you are making it much more convenient for customers who don’t have access to digital payments. A quick phone call or even paying by text message is much easier for some people, who don’t want to find passwords for logging in and don’t want to go through arduous verification processes. Not only does this increase customer satisfaction and loyalty, but it can have a significant impact on profits. If people don’t have immediate access to the internet or modern payment methods, you are still providing them a line with which to use your services or buy your products. There is also a speed with which phone transactions take place. As they are immediate, it does not involve a fragmented sales process of multiple touchpoints and abandoned shopping carts. Payment is made, the goods are purchased, then delivered.

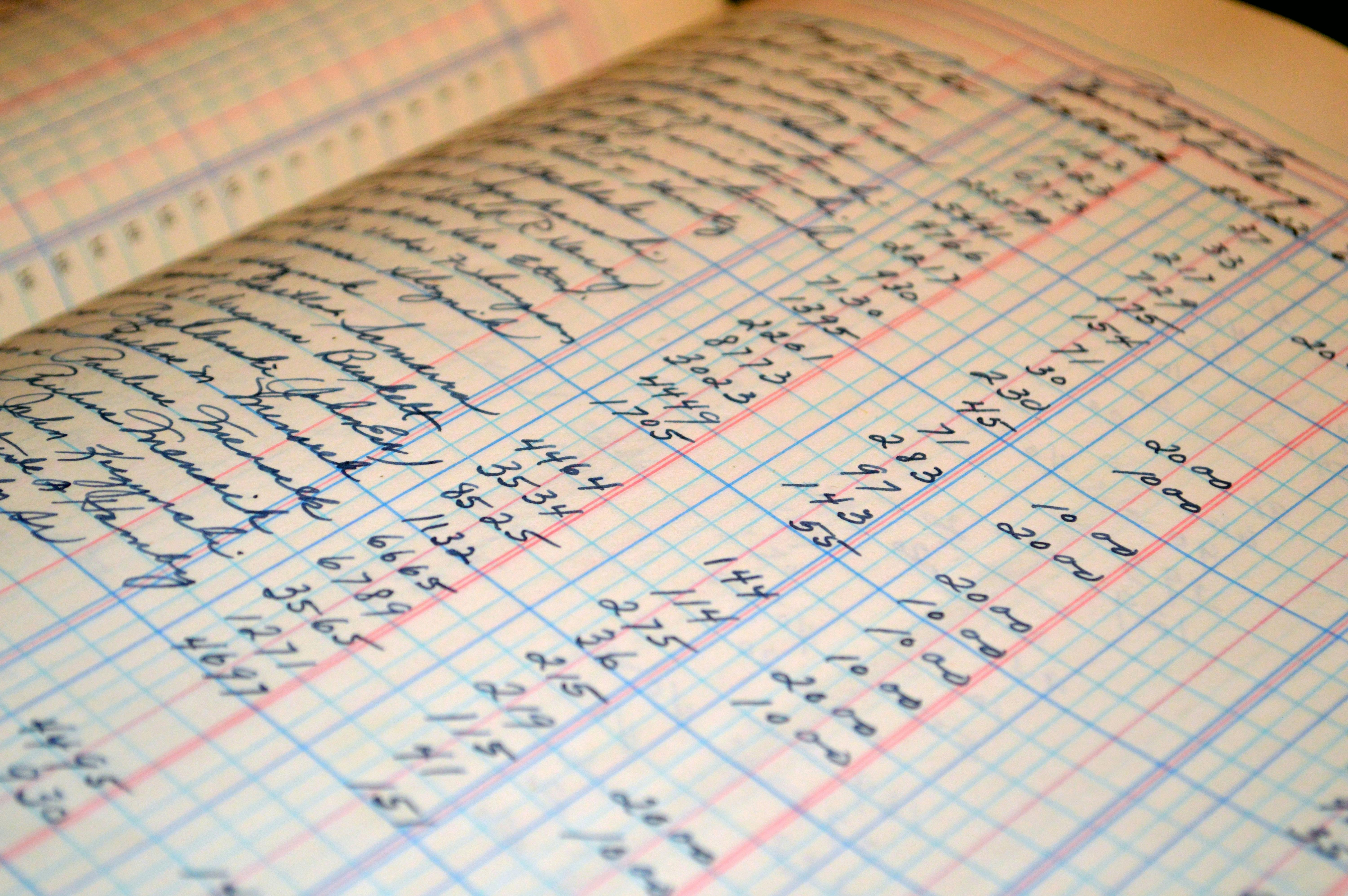

The Companies Still Using Paper Checks

Astoundingly, 75% of companies still use paper checks. This can create a number of problems for companies that both use and accept them and while it is another method of traditional payment that may benefit you, its long-term problems and value can diminish this. For companies that still use them, high costs and inefficiencies are to be expected. This is generally down to the manual processing required. This takes time and effort, which can hinder cash flow.

There has been a shift towards digital payment through these companies. Many of them are usually centered around the construction industry, with other sectors like retail having long phased them out. By changing to digital payments, companies get the benefit of much faster transactions and automated clearing. It is also worth noting that checks are ripe for fraud and manipulation, which is not as easy to do once you shift to digital payments. Yes, fees can be high, but they are not as exorbitant as they are on checks.

The Enduring Allure of Cash

A recent survey by YouGov in the United States showed that those buying in shops and retail environments actually still prefer cash. Around 67% of shoppers got money from ATM machines to pay for their products. The rest of this total was made up through cards and contactless payment methods, with a large 42% making chip-based debit payments the most favored.

There are many different reasons why Americans still prefer to use cash. The first is that cash helps people stick to a budget and is a valid way people manage money. When funds are being debited from accounts, it can be hard to see and remember what has been spent. It is easier when these goods are in your pocket. Cash also leaves no record of transactions. Not everyone wants every purchase from every store logged in their financial records. This can make cash a viable option when purchasing items that you don’t want others to find out about, from gifts to medication. Finally, many small vendors even prefer cash. With digital payment gateway costs rising, this allows them to keep more profit.

However, these trends do change when it comes to online purchases. Obviously, here cash is not an option, and credit cards become the most used method at 54%, followed by debit cards at 49%. Two-fifths of Americans preferred to use PayPal as their preferred payment gateway.

By no means should you get rid of modern payment methods. However, the evidence suggests that many people still want to pay using traditional methods. From cash to phone payments, they can benefit not just consumers but your business. Begin by getting an overview of the most popular payment methods being used in your business and ask customers what others would help. Their answers may surprise you.

Article Images

Source: pexels.com Copy article